Arvada Property Assessment Records

Arvada property tax records are maintained by two county assessors. This unique city spans both Jefferson and Adams Counties. Homeowners need to know which county manages their property assessments. The county boundaries run through various neighborhoods. Your tax records depend on your specific address. Both counties offer online search tools for finding property assessments and tax payment history.

Arvada Quick Facts

Which County Manages Your Arvada Tax Records

Arvada sits at the border of Jefferson and Adams Counties. The line splits the city. Most of Arvada lies in Jefferson County. The eastern parts fall under Adams County. You need to know your county to search the right records. Your tax bill shows which assessor handles your property.

Jefferson County manages properties west of Sheridan Boulevard. This includes most historic neighborhoods. The downtown area sits in Jefferson County. So do many newer developments. Adams County handles areas east of Sheridan. Some eastern Arvada neighborhoods cross into Adams County. Always verify your county before searching tax records.

Both counties use different online systems. Jefferson County has a property search portal. Adams County offers its own database. The records do not cross between counties. You cannot find Adams County properties on the Jefferson site. Each system works independently. Save time by checking your tax bill first.

Visit Arvada's official website to view city maps and boundary information. The city provides resources to help residents understand their county assignments. Your mailing address does not always match your county. Some Arvada addresses use Denver zip codes. The physical location determines your county for tax purposes.

Jefferson County Property Tax Records for Arvada

The Jefferson County Assessor maintains records for most Arvada properties. This office values over 300,000 parcels countywide. Arvada makes up a large portion of their work. The assessor updates values each year. Notices go out by May 1. Property owners can protest until June 1.

Contact the Jefferson County Assessor at 303-271-8667. Their office sits at 100 Jefferson County Parkway in Golden. You can also visit their Property Taxes page for online access. The website offers a property search tool. You can look up assessments by address or parcel number. Results show current values and tax history.

Jefferson County provides detailed property records. You can find ownership history. Tax payment status appears online. The system shows prior year values too. Many Arvada residents use this portal monthly. It helps track property values over time. Investors find this data useful for market research.

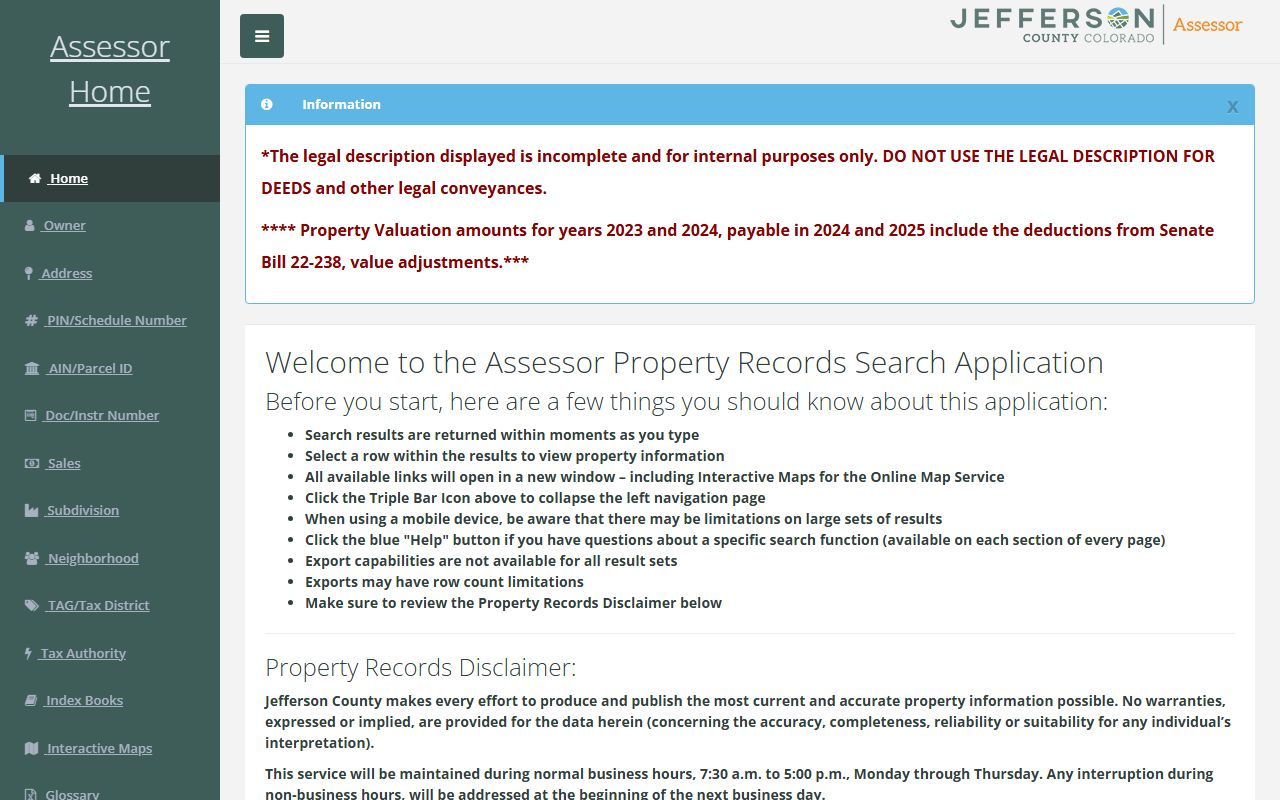

The Jefferson County property search tool displays assessment details and ownership information for Arvada homes.

Adams County Assessment Records for Arvada

Eastern Arvada falls under Adams County jurisdiction. The Adams County Assessor handles these property tax records. This covers a smaller portion of the city. Still, thousands of Arvada homes sit in Adams County. Those residents use different search tools. They follow Adams County protest deadlines.

Reach the Adams County Assessor at 720-523-6038. Visit their official page for online services. The office is located at 4430 S Adams County Parkway in Brighton. They offer property lookup by address or schedule number. Adams County updates values annually. Protest periods run through early June.

Adams County provides comparable sales data. This helps Arvada owners understand their assessments. The website lists recent sales near your property. You can check if your value matches the market. This matters when filing protests. Evidence of lower comparable sales strengthens your case.

Tax bills for Adams County properties come from the treasurer. First half payments are due in February. Second half payments come due in June. Late fees apply after deadlines. The treasurer accepts online payments. Credit cards carry convenience fees. E-checks cost less to process.

Note: Adams County offers a mobile app for property searches on your phone.

How to Search Arvada Property Tax Records

Finding property tax records in Arvada requires knowing your county. Start with your physical address. Check which side of Sheridan Boulevard you live on. West means Jefferson County. East means Adams County. Then visit the correct county website. Both offer online search portals.

You need basic information to search. Have your property address ready. The parcel number works even better. Find this on your tax bill. You can also search by owner name. Results show the current assessed value. You will see the property classification too. Residential rates differ from commercial rates.

Online searches provide instant results. You can view assessment history. Payment status appears clearly. Some records include building details. Square footage counts are listed. Year built shows on many records. Lot size appears for most properties. This helps verify accuracy of assessments.

Print your findings for your records. Keep copies of assessment notices. Save tax payment receipts. These documents help with future protests. They also prove payment history. Lenders sometimes request these records. Home sellers need them too. Good records make transactions smoother.

Understanding Arvada Property Assessment Values

Arvada property values reflect market conditions. Assessors look at recent sales nearby. They compare similar homes. Size matters. Location affects value. Condition plays a role. Updates can increase assessments. The goal is fair market value. This represents what your home would sell for today.

Colorado uses a two-year assessment cycle. Values change every odd-numbered year. Your 2023 value stays until 2025. Then the assessor updates it again. Market shifts between cycles do not affect taxes immediately. This creates some stability. Owners can plan for tax bills. Big market jumps get delayed.

Residential properties use a 6.25% assessment rate. This rate applies to your actual value. A $500,000 home has a $31,250 assessed value. Tax rates apply to this lower number. The actual value differs from assessed value. Do not confuse these terms. Your tax bill shows both numbers clearly.

Commercial properties face higher rates. The current rate is 27%. This includes vacant land. Multi-family housing uses this rate too. Business owners pay more per dollar of value. This balances the tax burden. Residential owners get lower rates. The system spreads costs across property types.

Arvada Property Tax Exemptions and Relief Programs

Colorado offers exemptions that lower Arvada tax bills. Senior citizens qualify for significant savings. You must be 65 or older. You need 10 years of ownership. The home must be your primary residence. The exemption covers half of the first $200,000 in value. This saves hundreds of dollars yearly.

Disabled veterans also qualify for exemptions. You need 100% permanent disability. The service connection must be documented. You must own and live in the home. The exemption matches the senior benefit. Half of the first $200,000 gets excluded. Applications are due by July 1.

Gold Star spouses may apply too. This applies to widows of service members. The death must be service-related. You cannot have remarried. You must live in the home. The exemption amount is the same. These programs honor military sacrifice. They reduce the tax burden on grieving families.

Apply through your county assessor. Jefferson County has online applications. Adams County offers paper forms. Submit by the July 15 deadline. Late applications get denied. You must reapply when moving. Each property needs a new application. The exemption does not transfer automatically.

Note: Both counties process exemption applications independently, so apply to the correct office for your property.

Appealing Arvada Property Tax Assessments

You can protest your Arvada assessment if it seems too high. The process starts with your county assessor. File by June 1 each year. This is the deadline for real property protests. Missing this date means waiting two years. Mark your calendar now. Early filing gives you more time to prepare.

Gather evidence before filing. Look at recent sales near your home. Find properties like yours. Check their assessed values. Are you higher than similar homes? Document any problems. Roof issues lower value. Foundation problems matter too. Photos help prove your case.

Submit your protest online or by mail. Jefferson County has an online portal. Adams County accepts electronic filings too. Include your evidence. State why the value is wrong. Be specific. Compare to similar properties. Request a specific lower value. Clear arguments get better results.

The assessor reviews your protest. They may adjust your value. They will send a decision notice. If you disagree, appeal further. The County Board of Equalization hears appeals. File by July 20. You can present your case in person. Bring all your evidence. The board decides by August 5.

Paying Property Taxes in Arvada

Arvada residents pay taxes to their county treasurer. Jefferson County and Adams County handle collections separately. Tax bills arrive in January. They reflect the prior year's assessments. First half payments are due February 28. Second half payments come due June 15. Plan for these dates.

Both counties offer online payment options. Credit cards work but cost extra. E-checks have lower fees. You can pay by mail with a check. In-person payments work too. County offices accept cash and checks. Some offer payment plans for large bills. Contact the treasurer for details.

Late payments incur penalties. Interest adds up quickly. Colorado law sets the rates. Do not ignore tax bills. Even if you protest your value, pay on time. You can get refunds if you win. But late fees stick if you do not pay. Protect your credit. Pay by the deadlines.

County Resources for Arvada Property Tax Records

Arvada spans two counties. Each county maintains separate records. You need the right county for your property. Jefferson County covers most of the city. Adams County handles eastern areas. Both provide online tools. Both have phone support. Choose based on your address.