Grand Junction Assessment Records

Grand Junction property tax records are maintained by the Mesa County Assessor for all 65,560 residents of this western Colorado city. Located at the confluence of the Colorado and Gunnison Rivers, Grand Junction serves as the county seat and commercial hub of Mesa County. Property owners can access assessment values, ownership details, and tax payment status through the county's online portal or by visiting the assessor's office in person.

Grand Junction Quick Facts

Grand Junction Property Assessment Office

The Mesa County Assessor maintains all property tax records for Grand Junction parcels. This office values residential, commercial, and agricultural land each year. Staff review sales data to set fair market values. They follow state rules for assessments. The assessor certifies values to tax districts by set dates.

Grand Junction sits in the heart of Mesa County. The assessor's office is downtown. You can call them at 970-244-1610. They handle questions about property values. They also take exemption forms. Seniors and disabled vets can save on taxes. Visit the Mesa County Assessor website for full details.

Property records in Grand Junction show parcel data, legal descriptions, and building facts. The assessor tracks land and structure values. You can search online with an address or parcel number. Results show current assessed values and past sales. Some files include photos and sketches.

You can learn more about assessment procedures through the Mesa County Assessor homepage which provides forms and contact information.

The Mesa County Assessor portal connects Grand Junction residents to property search tools and exemption applications.

Search Grand Junction Property Tax Records Online

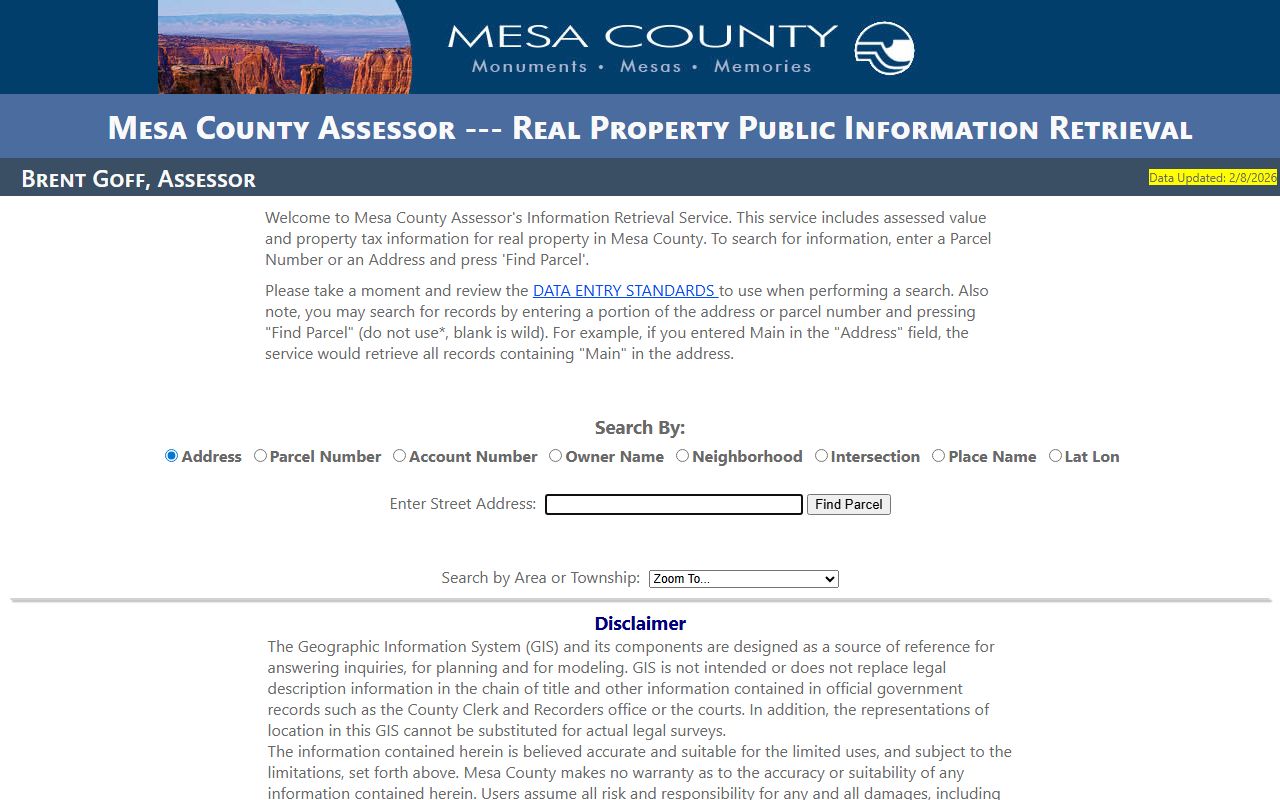

Finding property tax records for Grand Junction is easy. The Mesa County Assessor provides a free online lookup tool. You can search by owner name, address, or parcel number. The system shows current values and tax status. Results update as new data comes in.

The Mesa County Assessor Lookup covers all Grand Junction properties. You can view ownership history and building details. Sales information is available too. The tool works for homes and businesses. You can access it day or night.

To search Grand Junction property tax records, you will need:

- Street address or parcel number

- Owner name if known

- Property type for better results

The online lookup system provides instant access to Grand Junction property assessments and tax details.

For complex searches, visit the assessor's office in Grand Junction. Staff can help with historical records. They explain how values are set. Bring your parcel number to speed things up. The office opens Monday through Friday.

Grand Junction Tax Payment Details

Property taxes for Grand Junction homes and businesses are collected by the Mesa County Treasurer. Tax bills go out after January 1. They cover the prior year's taxes. The first payment is due by February's end. The second half is due June 15.

Mesa County offers many ways to pay. You can pay online with a card or e-check. Fees may apply for credit cards. Mail payments need your parcel number. In-person payments take cash, check, or card. The treasurer's office sits in Grand Junction.

Visit the Mesa County Treasurer website to pay Grand Junction property taxes online or view tax bills.

Late payments add interest and fees. Colorado law sets these charges. Pay on time to avoid extra costs. If you need help, call the treasurer. Some payment plans exist for hardship cases. Keep your receipts as proof of payment.

Note: Tax bills are mailed to the address on file with the assessor's office.

Grand Junction Property Tax Exemptions

Grand Junction residents may qualify for property tax relief. The Senior Citizen Exemption helps those 65 and up. You must have owned and lived in your home for 10 years. The exemption cuts 50% off the first $200,000 in value. File by July 15 each year.

Veterans with 100% disability also qualify. They must have served on active duty. The disability must tie to service. They must own and live in the home. The exemption matches the senior program. The deadline is July 1.

The Mesa County Assessor handles all exemption forms. Staff can check if you qualify. They provide the forms you need. They list what documents to bring. Call early to meet the deadlines.

Grand Junction City Government

The City of Grand Junction works with Mesa County on property matters. The city handles zoning and building permits. They do not set tax values. That is the county's job. The city website has local rules and forms.

You can visit the Grand Junction city website for zoning and permit information. The city does not keep tax records. All property tax records stay with the Mesa County Assessor.

Mesa County Property Tax Records

Grand Junction is the county seat of Mesa County. All property tax records for the city are part of the county system. The Mesa County Assessor serves Grand Junction plus other towns in the county. For more resources and county-wide information, visit the Mesa County page.