Westminster Property Tax Lookup

Westminster property tax records are maintained by both Adams and Jefferson County Assessors for this northwest Denver suburb of 116,317 residents. Located between Denver and Boulder, Westminster spans the county boundary between these two counties. Property owners must contact the correct assessor based on their parcel's location within the city limits.

Westminster Quick Facts

Westminster Property Records by County

Westminster spans Adams and Jefferson Counties northwest of Denver. Most of the city lies in Adams County. The western portions extend into Jefferson County. You need to know which county contains your property. Each assessor keeps separate records for Westminster parcels.

For Adams County portions of Westminster, contact the assessor at 720-523-6038. The Adams County Assessor website offers online search tools. You can find assessments and tax status for Westminster properties here.

For Jefferson County portions, call 303-271-8667. The Jefferson County Assessor website maintains records for Westminster parcels in this county. Be sure to use the right system for your address.

The Jefferson County Assessor maintains Westminster property tax records for the western portions of the city.

Note: Check your property deed or tax bill to determine which county assessor handles your Westminster property.

Search Westminster Tax Records Online

Finding property tax records in Westminster requires knowing your county. Adams and Jefferson Counties use different search systems. You cannot search all Westminster properties in one place. You must use the correct county portal.

Adams County offers property search for Westminster homes in this county. You can search by address or parcel number. The system shows current assessments and ownership. Results include tax status and history.

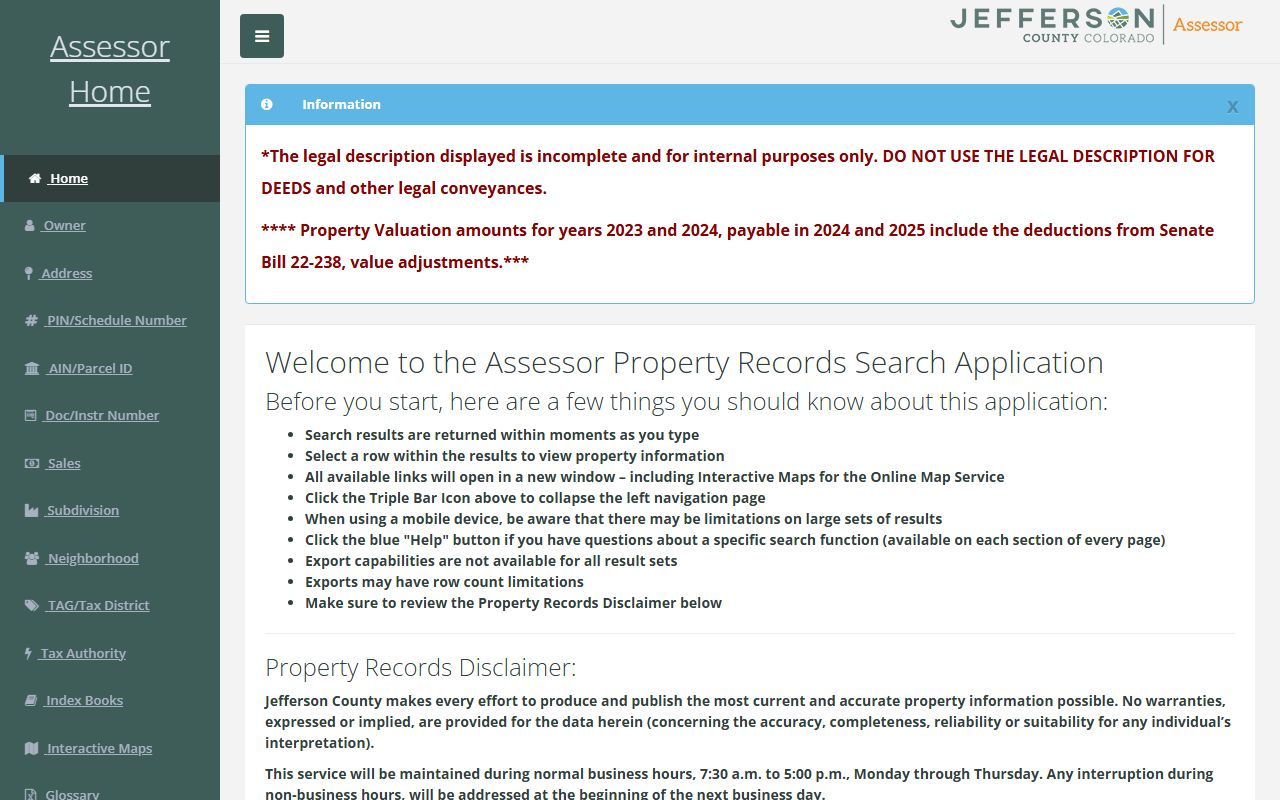

Jefferson County provides online access through their Property Search system. Westminster properties in this county appear in these results. You can view values and property details.

The Jefferson County Property Search covers Westminster properties in Jefferson County.

To search Westminster property tax records, you will need:

- Property address or parcel number

- Knowledge of which county contains your property

- Owner name for person-based searches

Westminster Property Tax Payments

Property taxes for Westminster are collected by Adams and Jefferson County treasurers. Each county handles its portion of the city. Tax bills arrive after January 1. They cover the prior year's taxes. Deadlines are the same across both counties.

Adams County residents can pay online through the treasurer's website. The system accepts credit cards and e-checks. Convenience fees may apply. Mail payments should include your parcel number.

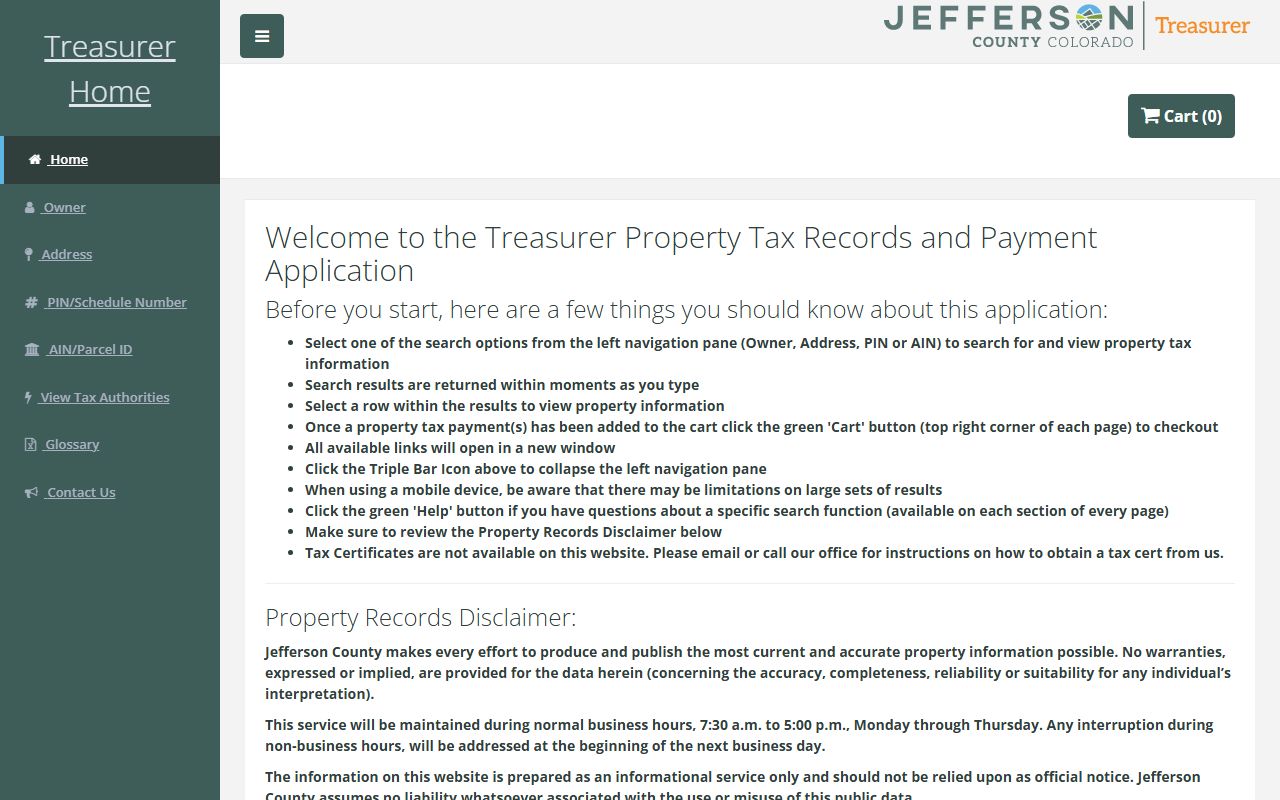

Jefferson County residents use their treasurer's payment system. Be sure to pay the correct county for your Westminster property.

The Jefferson County Treasurer Property Search allows online payments for Westminster properties in Jefferson County.

First half payments are due by the end of February. Second half payments are due June 15. Late payments add interest and penalties under Colorado law. Keep all receipts for your records.

Note: Tax bills are mailed to the owner of record as of January 1 each year.

Westminster Property Tax Exemptions

Westminster residents may qualify for property tax exemptions. The Senior Citizen Exemption helps those 65 and older. You must have owned and occupied your home for 10 years. The exemption covers 50% of the first $200,000 in value. Applications are due July 15.

Veterans with 100% permanent disability also qualify. They must have served on active duty. The disability must be service-connected. They must own and live in the property. The exemption covers 50% of the first $200,000. The deadline is July 1.

Apply through the county assessor where your property is located. Adams County handles most Westminster applications. Jefferson County handles their portion. Both follow the same state exemption rules.

Appeal Westminster Property Assessments

You can protest your Westminster property assessment. File with the county assessor for your property's location. The deadline is June 1 for real property. Both counties follow state appeal procedures.

If you disagree with the assessor, appeal to that county's Board of Equalization. The deadline is July 20. The board holds hearings through the summer. They issue written decisions by set dates.

After the board decision, you can appeal to the Board of Assessment Appeals, file in district court, or choose binding arbitration. You have 30 days from the board decision.

Westminster City Government

The City of Westminster provides local services across both counties. They manage zoning and building permits. They do not set property tax values. The county assessors handle that function. The city website has local regulations.

Visit the Westminster city website for zoning information and permits. Property tax records remain with Adams or Jefferson County. Contact the appropriate county assessor based on your location.

County Property Tax Records for Westminster

Westminster spans parts of Adams and Jefferson Counties. Each county maintains separate property tax records for their portion of the city. Visit the appropriate county page: