Delta County Property Tax Lookup

Delta County property tax records are maintained by the county assessor. This western Colorado county serves over 32,000 residents from the city of Delta. The assessor's office values all real and personal property for tax purposes. The mission is to value Delta County with the highest standards of professionalism. You can access property tax records by phone or in person.

Delta County Quick Facts

Delta County Assessor Office

The Delta County Assessor operates from 501 Palmer Street, Suite 210 in Delta. This office determines property values for the entire county. Staff comply with the Colorado Constitution, Statutes, and Regulations. They work to ensure fair and accurate valuations. The assessor's work supports local government and public services.

You can reach the assessor at 970-874-2120. The office is open during regular business hours. Staff can help you find property tax records. They also explain assessment notices. Visit the Delta County Assessor website for current information.

Property tax records in Delta County include residential, agricultural, and commercial properties. The assessor reviews market conditions annually. Values adjust to reflect sales activity. Notices of valuation mail by May 1. Property owners have the right to protest these values.

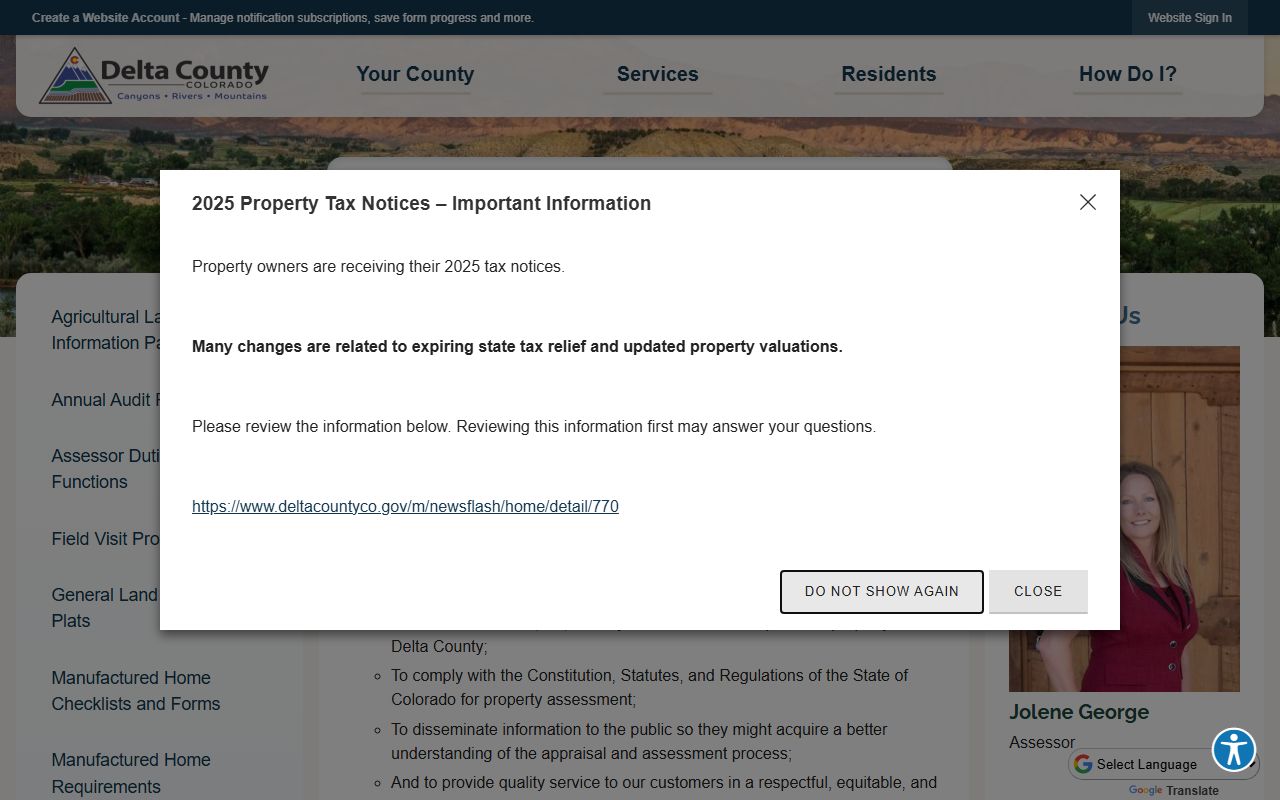

The Delta County Assessor website provides information about the assessment process and property valuation standards.

Delta County Property Tax Distribution

Property taxes in Delta County fund various local services. The distribution shows where your tax dollars go. Schools receive the largest share. The county government gets a portion. Special districts and towns also receive funding.

The typical distribution of property taxes in Delta County includes: 47% for schools, 24% for the county, 27% for special districts, and 2% for towns. This breakdown shows the importance of property tax revenue for education. Local services also depend on these funds.

Property tax revenue sources in Delta County vary by type. Residential properties contribute 56% of revenue. Commercial properties add 16%. Agricultural land contributes 7%. State assessed properties add 12%. Other categories include industrial, vacant land, and natural resources.

Delta County Tax Payment Information

Property taxes in Delta County are collected by the county treasurer. The treasurer's office is at 501 Palmer Street in Delta. You can reach them at 970-874-2100. They process tax payments and answer questions.

Tax bills arrive after January 1 each year. They reflect taxes for the previous year. First half payment is due by February 28. Second half comes due June 15. Full payments under $25 are due April 30.

Delta County offers several payment methods. You may be able to pay online. Contact the treasurer for current options. You can also pay by mail or in person. Always get a receipt. Keep this for your tax records.

Late payments incur interest under Colorado law. The rates add up quickly. Pay on time to avoid extra costs. If you cannot pay in full, contact the treasurer. They may offer a payment plan. Never ignore a tax bill.

Search Delta County Property Tax Records

Accessing property tax records in Delta County requires direct contact. The office provides personal assistance. Call or visit during business hours. Staff will search records for you. They provide current assessed values and ownership details.

When requesting Delta County property tax records, have your parcel number ready. If you lack this, provide the property address. Staff can locate records using either. Some requests may take time to process.

The Colorado Division of Property Taxation lists county contacts. This helps you reach the right office. It includes addresses and phone numbers.

Delta County Property Tax Exemptions

Colorado offers property tax exemptions for qualified Delta County residents. These programs reduce your taxable value. Savings can be significant. Programs help seniors and veterans.

The Senior Citizen Property Tax Exemption applies to homeowners 65 and older. You must have owned and lived in your home for 10 years. The exemption covers 50% of the first $200,000 in value. Applications are due by July 15. Contact the Delta County Assessor.

Veterans with 100% permanent disability also qualify. Service-connected disability is required. Active duty service is required. The exemption matches the senior program. Deadline is July 1. Bring VA documentation.

Learn more at the Colorado Senior and Veteran Exemptions page. This explains requirements. Forms are available.

Appeal Delta County Property Assessments

You can protest your Delta County property value. State law provides this right. Contact the county assessor first. File a written protest by June 1. Include reasons and evidence.

The assessor reviews protests. They may change your value. You get a written decision. If you disagree, appeal further. The County Board of Equalization hears appeals. Deadline is July 20. The board meets through summer.

After the CBOE, three options remain. Appeal to the Board of Assessment Appeals. File in district court. Or choose binding arbitration. Each has unique rules. You have 30 days after the CBOE decision.

The Colorado protests and appeals page provides instructions. Review before filing. Strong appeals need comparable sales. Photos help. Explain why your value is wrong.

Note: Keep copies of all documents submitted during the appeal process.

Colorado Resources for Delta County

The Colorado Division of Property Taxation provides statewide guidance. They oversee all 64 county assessors. This includes Delta County. The division sets assessment standards. They audit county practices.

Property taxes follow Title 39 of the Colorado Revised Statutes. These laws create the tax system. They set assessment rates. They define protest deadlines. They establish taxpayer rights.

Assessment rates vary by property type. Residential uses 6.25% for local taxes. Commercial and agricultural use 27%. Rates apply to actual value. This creates your assessed value. Tax bills calculate from this amount.

Nearby Colorado Counties

For property tax records near Delta County, check these neighboring counties: