Larimer County Property Tax Lookup

Larimer County property tax records are maintained by the County Assessor in Fort Collins, Colorado. The county serves 374,574 residents across its communities. Property owners can access assessment data, tax records, and valuation information through the assessor's office. The county seat provides centralized access to property tax documents and related services for all parcels within Larimer County boundaries. These public records help owners understand their property values and tax obligations.

Larimer County Quick Facts

Larimer County Assessor Office

The Larimer County Assessor manages all property tax records for parcels within the county. This office determines property values for tax purposes. Staff handle assessment appeals and property valuation questions. You can contact them by phone or visit their office in Fort Collins to speak directly with assessment professionals.

The assessor reviews property characteristics and current market data. They set values each assessment cycle according to Colorado law. Property owners receive notices when values change. You can discuss your assessment with staff if you have concerns about the valuation. They explain how they reached your property value using standard methods.

Assessment records form the basis for property taxes. The county uses these values to calculate what each owner owes. Accurate records help ensure fair taxation across all property types. Residential, commercial, and agricultural land each have different valuation approaches. The assessor maintains files on every parcel in Larimer County.

The Larimer County Assessor website provides access to property tax records and assessment information for local property owners.

You can use these tools to look up property tax records in Larimer County.

| Assessor Phone | 970-498-7050 |

|---|---|

| County Seat | Fort Collins |

| Population | 374,574 |

| Assessor Website | www.larimer.gov/assessor |

Note: Office hours may vary by season. Call ahead to confirm before visiting the Larimer County Assessor office.

How to Search Larimer County Property Tax Records

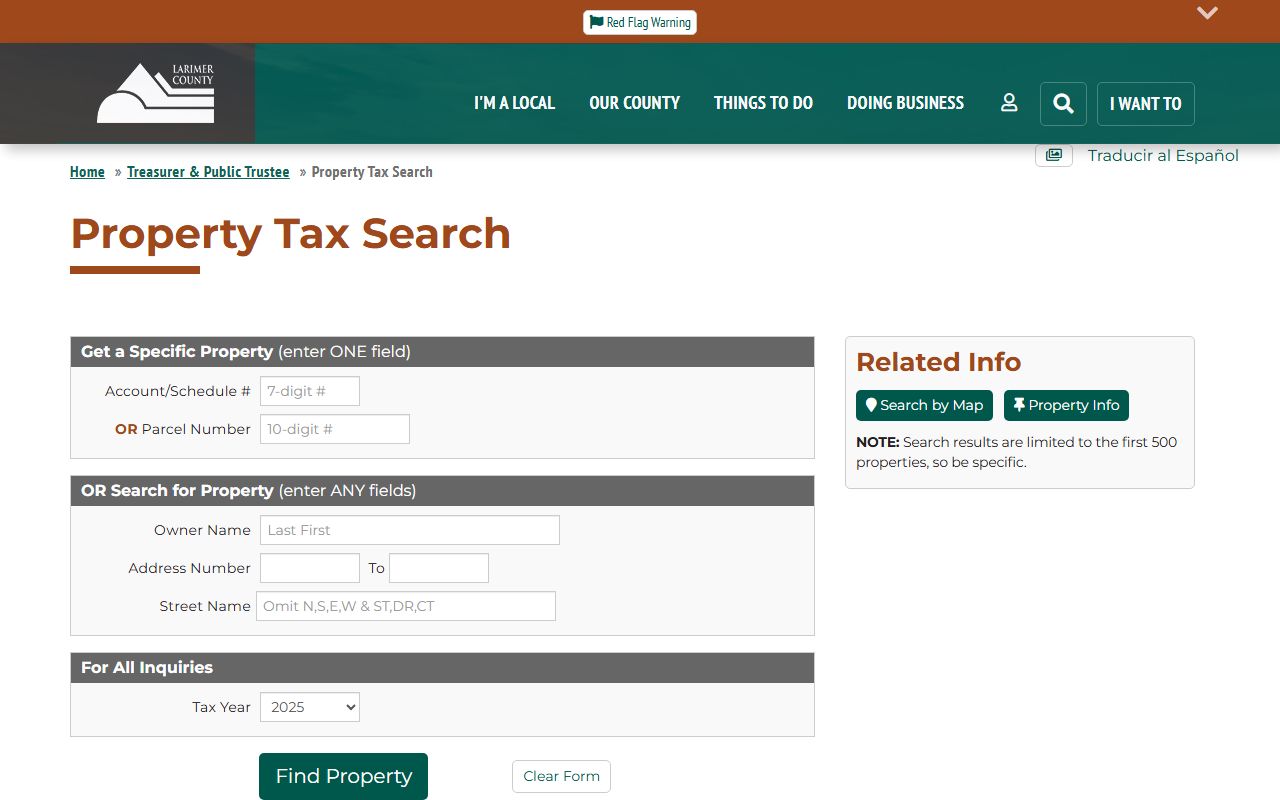

You can find property tax records in several ways depending on your needs. The assessor's office holds physical files for all parcels. Many records are also available through online systems. Choose the method that works best for your specific situation.

Contact the assessor directly for specific questions about a property. Staff can help you locate records quickly. They assist with parcel searches and ownership history research. In-person visits allow you to review complete documents. Phone calls work well for quick questions.

The county provides online access to property tax records through a web portal. You can search by address or parcel number to find specific properties. Visit the online portal to begin your search immediately. This system shows current values and tax payment history for each parcel. Some detailed records may still require an in-person visit to view.

The Larimer County Assessor website provides access to property tax records and assessment information for local property owners.

You can use these tools to look up property tax records in Larimer County.

To search Larimer County property tax records effectively, gather this information before you start:

- Property address or parcel number from tax documents

- Owner name if searching by person rather than address

- Approximate year of purchase or last sale

- Legal description if available from deeds

Property tax records contain valuable information. You can find assessed values, improvement details, and land characteristics. Ownership history shows previous transfers. Tax payment records indicate current status. Some files include building sketches and photos.

Note: Some older records may only exist in paper format at the assessor's office in Fort Collins.

Larimer County Property Assessment Process

Colorado law requires counties to assess property values on a regular schedule. The assessor reviews sales data and physical property features. These values determine how much tax each owner pays. Assessments happen every two years in odd-numbered years.

Notices go out when values change from the previous cycle. Property owners can appeal if they disagree with the new valuation. The appeal window is limited to specific dates. Check your notice for exact deadlines in Larimer County. You need evidence to support a different value claim.

The Larimer County Assessor website provides access to property tax records and assessment information for local property owners.

You can use these tools to look up property tax records in Larimer County.

Assessment appeals follow a formal process established by Colorado statute. First, contact the assessor informally to discuss concerns. Many issues resolve at this stage without formal action. If not satisfied, file a formal appeal with the county. The Larimer County Board of Equalization hears disputed cases.

Good evidence strengthens your appeal case. Recent sales of similar properties carry significant weight. Photos showing condition issues or problems help support lower values. Professional appraisal reports provide strong backing. Prepare your case thoroughly before filing any appeal.

The board schedules hearings for formal appeals. You can present your evidence in person. The assessor also presents their valuation method. Board members ask questions to understand both positions. Decisions typically come within a few weeks of the hearing.

Larimer County Property Tax Payments

Property taxes fund essential local services throughout Larimer County. The County Treasurer collects these payments from all property owners. Tax bills arrive each year with payment instructions. Deadlines are strict under Colorado law. Late payments incur penalties and interest charges.

You can pay taxes through several convenient methods. Many counties accept secure online payments by card or bank transfer. Mail works well for checks sent before deadlines. In-person payments use cash, check, or card at the office. Some locations have secure drop boxes for after-hours payments.

Visit the Treasurer's website for current payment options and amounts. You can look up exact tax amounts due for any parcel. The site shows payment history and current status. Set up alerts for upcoming deadlines to avoid late fees.

Property taxes support schools, roads, and public safety. Each parcel contributes based on its assessed value. Mill levies vary by location within Larimer County. Taxing districts include the county, cities, and special districts.

Understanding Larimer County Property Values

Property values directly drive the amount of tax owed each year. The assessor studies market conditions and sales trends. Location significantly affects value throughout the county. Size and physical condition matter too. Improvements like additions increase assessments.

Residential and commercial properties use different valuation methods. Homes compare to recent sales of similar properties nearby. Income properties use revenue and expense data in calculations. Land values depend on use type and specific location. Agricultural land has special valuation rules under state law.

Exemptions reduce taxable value for qualifying owners. Seniors over 65 may qualify for substantial relief. Veterans with service-connected disabilities can apply for exemptions. Primary residences get some protection from sharp increases. Check with the assessor about available programs in Larimer County.

Market value represents what a property would sell for currently. Assessed value is a percentage of market value set by law. The assessment rate differs by property type. Residential properties use one rate. Commercial and other types use higher rates.

Types of Larimer County Property Tax Records

The assessor maintains various property documents for public access. Assessment rolls list all parcels in the county. Ownership records show current and past owners for research. Valuation history tracks changes over multiple assessment cycles.

Property cards describe physical characteristics of each parcel. Sketch plans show building layouts and dimensions. Sales records document property transfers between owners. Appeal files contain dispute information and hearing results. Maps display parcel boundaries and zoning districts.

Public access varies by record type and privacy rules. Most assessment data is open to anyone. Some owner details may have restricted access. Historical records might need special requests to retrieve. Contact the office to learn what records are available for your research needs.

Counties Near Larimer County

Property tax records for neighboring counties may be relevant to your search. Some properties sit near or span county lines. Owners living near borders need to contact the correct office. Here are nearby Colorado counties with their own assessor offices:

Each county maintains separate property tax records. Values and processes may differ between counties. Always verify you are searching in the correct jurisdiction for accurate results.