Denver Property Assessment Records

Denver property tax records are managed by the City and County of Denver. Denver is a consolidated city-county. This means one government handles everything. All Denver properties fall under the same assessor. Over 200,000 parcels are valued. The city has the largest property tax system in Colorado. Records are accessible online.

Denver Quick Facts

Denver Assessor Property Tax Records

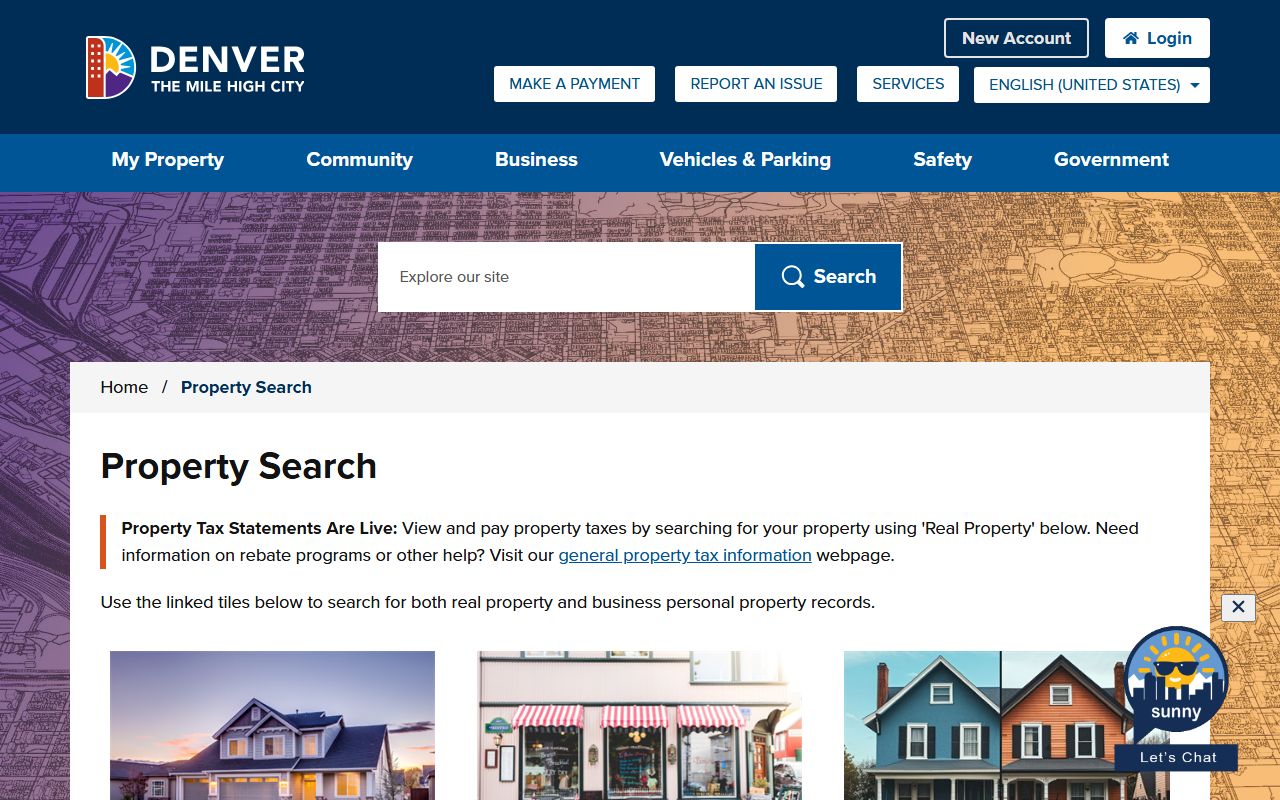

The Denver Assessor manages all Denver property records. The office is at 201 W Colfax Avenue. This is in the Wellington Webb Building. The assessor values over 200,000 parcels. Residential homes are the majority. Commercial properties are numerous. Industrial areas exist too. All are valued by the same team.

Contact the Denver Assessor at 720-913-1311. Visit their property assessment page for online tools. The website offers a property search portal. You can look up assessments by address. Parcel number searches work well. Owner name lookups are available. Results show current and past values.

Denver provides detailed online records. You can view assessment history. Tax payment status appears clearly. Building characteristics are listed. Square footage is included. Year built shows on records. Lot dimensions appear. Photos are available for many properties. All this helps verify accuracy.

The Denver Assessor property search tool displays assessment values and property details for Denver homes and businesses.

How to Search Denver Property Tax Records

Searching Denver tax records is straightforward. Start at the Denver website. Navigate to the assessor section. Click on property search. Enter your street address. The system finds your parcel. Results display instantly. You can also search by parcel number.

The online portal shows key information. Current assessed value appears first. This determines your tax amount. Actual value shows below. This estimates market worth. The assessment rate is applied. Residential properties use 6.25%. Commercial rates are higher.

Review your property details carefully. Verify the square footage. Confirm the year built. Check the lot size. Errors affect your value. Report mistakes to the assessor. They can correct records. This may lower your assessment. Accuracy benefits everyone.

Save your search results. Print pages or save as PDFs. Keep records for your files. You need them for taxes. Lenders may request them. Buyers want tax cost information. Good records help with protests. They prove your case. Stay organized.

Note: Denver's property search system is one of the most comprehensive in Colorado, with detailed records for every parcel in the city.

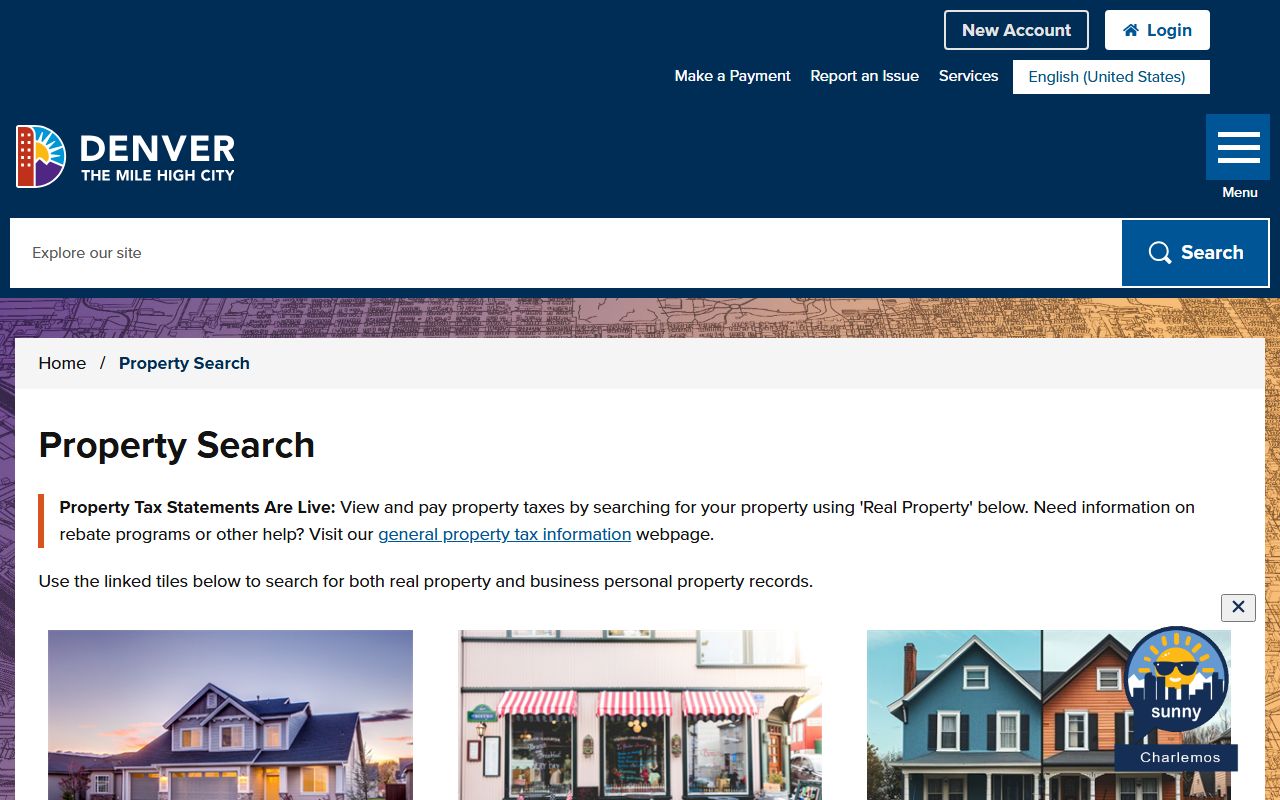

Denver Property Search Online Tool

Denver offers a dedicated property search website. Visit Denver Property for direct access. This site is user-friendly. You can search by address easily. Schedule numbers work too. The system is fast. Results appear immediately.

The property search shows comprehensive data. Ownership history is included. Assessment values are clear. Tax payment status appears. Building details are listed. Zoning information is available. Sales history shows past transactions. All this data is public.

Use this tool to research properties. Buyers check values before purchasing. Sellers verify their assessments. Owners monitor their values. Investors research neighborhoods. The data helps everyone. It promotes transparency. Fair assessments depend on informed citizens.

The Denver Property search website provides comprehensive access to property records and assessment data for all Denver parcels.

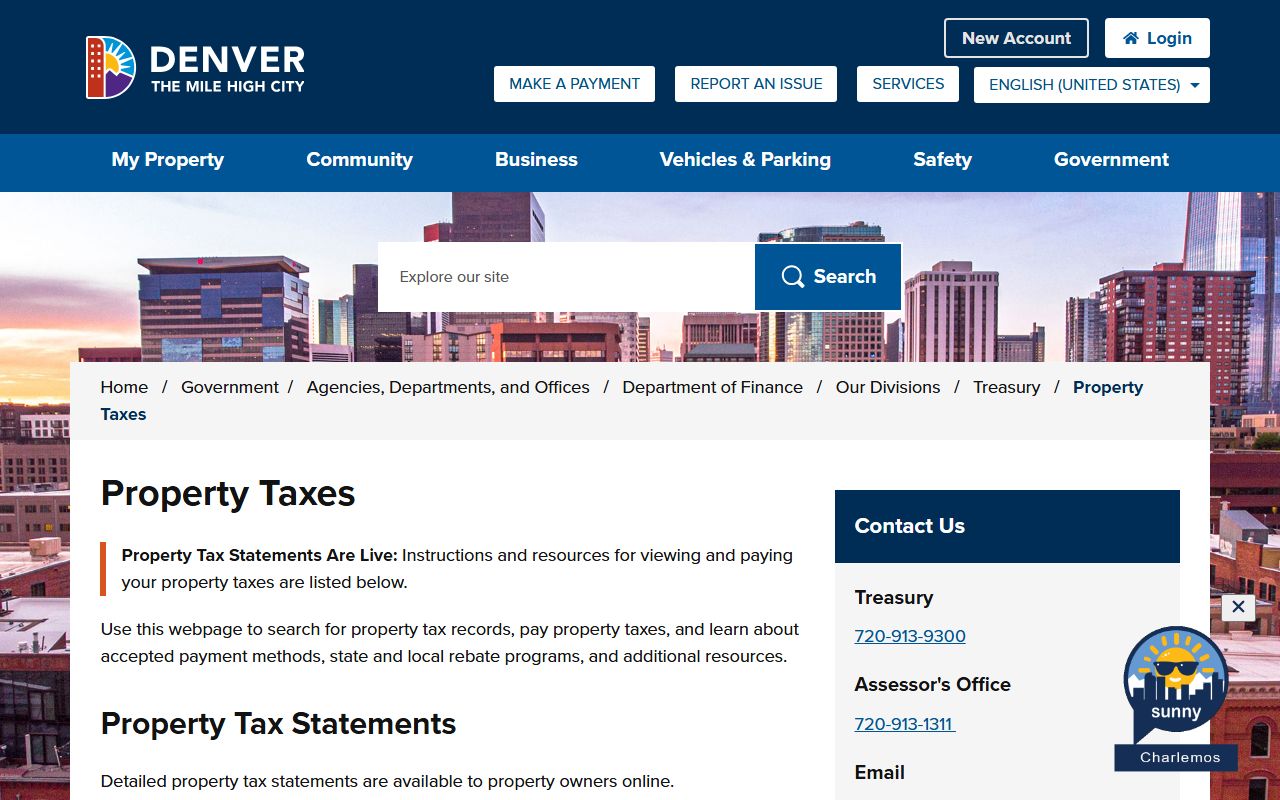

Denver Treasury Division Tax Payments

The Denver Treasury Division collects all property taxes. Contact them at 720-913-9300. Visit their Property Taxes page for payment options. The treasury sends tax bills. They process all payments. They handle delinquencies too.

Tax bills arrive in January. They reflect the prior year's assessments. First half payments are due February 28. Second half comes due June 15. Some owners pay in full. Others prefer splitting payments. The treasury accepts many payment methods.

Denver offers convenient payment options. Online payments work well. Credit cards are accepted. Fees apply for card use. E-checks cost less. Mail payments are fine. In-person payments work too. The treasury office takes cash and checks. Payment plans may be available.

The Denver Treasury Division website provides online payment options and tax bill information for Denver property owners.

Understanding Denver Property Assessment Values

Denver property values vary widely by neighborhood. Downtown condos have high values. Historic districts command premiums. Suburban areas vary. The assessor looks at comparable sales. Location affects value greatly. Proximity to amenities matters. School quality influences values.

Assessment dates are fixed by state law. Values reflect January 1 of the assessment year. This date never changes. Sales after January 1 do not count. Values update every two years. Odd-numbered years bring new assessments. Your 2025 value stays until 2027. Market shifts mid-cycle are ignored.

Residential assessment rates are 6.25%. This applies to actual value. A $500,000 home has a $31,250 assessed value. Mill levies apply to this number. Denver has various tax districts. City taxes add to county taxes. Schools take a significant share. Special districts add more.

Commercial properties use 27%. This includes apartments with four or more units. Office buildings pay this rate. Retail spaces do too. Vacant land also uses 27%. These higher rates balance revenue. Residential owners pay less per dollar. The system spreads costs fairly.

Denver Property Tax Exemptions and Programs

Denver residents qualify for state exemptions. Senior citizens get significant relief. You must be 65 or older. Ten years of ownership is required. The home must be your primary residence. The exemption removes half the first $200,000 in value. This saves hundreds each year.

Disabled veterans qualify too. You need 100% permanent disability. Service connection must be documented. You must own and occupy the home. The exemption matches the senior benefit. Apply by July 1. Medical documentation is needed. Service records help.

Gold Star spouses may apply. This helps widows of fallen service members. The death must be service-connected. You cannot have remarried. Primary residence is required. The exemption amount is identical. These programs honor sacrifice. They ease financial burdens.

Apply through the Denver Assessor. Forms are available online. You can visit the office too. Submit before July 15. Late applications are denied. You must reapply when moving. Each property needs a new filing. Keep copies of all documents.

Appealing Denver Property Tax Assessments

You can protest your Denver assessment. File by June 1 each year. This is the deadline for protests. Do not wait until the last day. Gather evidence early. Start when you receive your notice. The assessor reviews many protests. Early filing helps your case.

Review your assessment notice carefully. Compare to similar homes. Look at recent sales nearby. Are you higher than comparable properties? Document any differences. Note condition issues. System problems reduce value. Outdated features matter too. Photos help prove your case.

File your protest with the Denver Assessor. Online filing is available. Include your evidence. State your requested value. Be reasonable. Cite comparable sales. The assessor reviews everything. They may adjust your value. You will get a decision notice.

If you disagree, appeal further. The Denver County Board of Equalization hears cases. File by July 20. Present your evidence in person. The board decides by August 5. You can appeal to state level. The Board of Assessment Appeals reviews these. You have 30 days to file.

City and County of Denver Resources

Denver offers unified city and county services. Visit Denver's official website for all services. The site lists departments clearly. You can find assessor information. Treasury details are there too. Building permits are online. Business licenses are available.

The consolidated government has benefits. One system serves everyone. Records are centralized. Services are coordinated. The assessor and treasury work together. This helps property owners. Questions get resolved faster. Information is easier to find.

Denver continues to grow. New developments add properties. The assessor keeps pace. Records stay current. Values reflect market changes. The city-county model works well. Residents benefit from efficiency. Tax records are easy to access.

The Denver website provides comprehensive tax payment options and property assessment information for city residents.

Denver County Property Tax Records

Denver is both a city and a county. This unique status means all property tax records are managed locally. The consolidated government provides streamlined services for property owners. For more information about Denver assessments and tax records, visit the county page.